Click. Compare.

We'll take it from there.

Life insurance on your terms. At the lowest price.

Free, only 2 minutes and no obligation.

Get life insurance in 3 easy steps

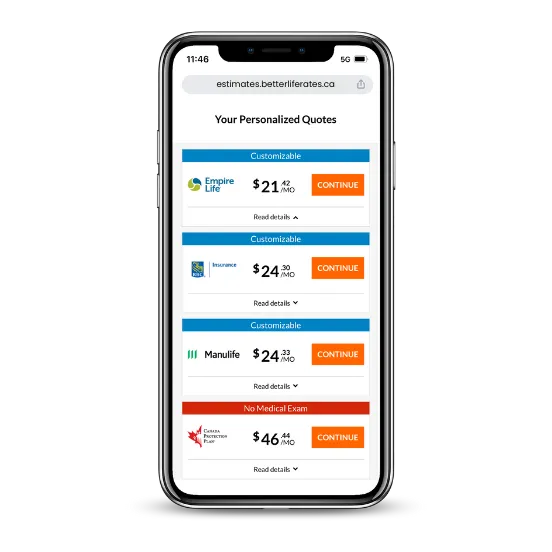

Get an instant quote

You’ll get no-obligation quotes in seconds from the best insurance companies in Canada.

Get an instant quote

You’ll get no-obligation quotes in seconds from the best insurance companies in Canada.

The Better Life Experience.

"Very intuitive process and responsive advisors. Couldn't have done it without them!"

Jeremy Dab

Jeremy Dab

Frequently Asked Questions

What is life insurance?

Life insurance is a contract between you and the insurer. You pay a fixed monthly amount (called the premium) and the insurer pays out a lump sum of money (the death benefit) to your beneficiaries (loved ones) when you pass away.

Do I need life Insurance?

If you have dependents or loved ones, you likely need life insurance. For parents, life insurance protects your family. First-time home buyers need it for their mortgage. Even if you have life insurance through work, it is often not enough to cover your family's needs (and is tied to staying with your company). If you're unsure, click Check My Price to determine your coverage needs today.

What is the life insurance policy at Better Life?

Start with our 2-minute needs analysis (Check My Price button). If you need assistance, get a free personalized recommendation from a licensed life insurance advisor. During the application, we ask a short series of questions to understand your health and lifestyle. In some cases, a medical exam is recommended. An advisor reviews your application and submits it to the insurance company.

What kind of insurance does Better Life offer?

As independent brokers, we offer life insurance products from Canada's top insurers. This includes term life insurance (suitable for most people), whole life insurance, critical illness insurance, disability insurance, & more.